are oklahoma 529 contributions tax deductible

Ad Enjoy Tax-Free Withdrawals For Higher Education Expenses With ScholarShare 529. Setting Up a College Savings Plan Early Can Save You Money on Education Costs.

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar College Savings Plans 529 College Savings Plan Savings Plan

Any ScholarShare 529 Earnings Grow Tax Free With Qualified Withdrawals.

. Ad At Vanguard Were Committed to Helping Families Like Yours Save for College.

529 Tax Deductions By State 2022 Rules On Tax Benefits

Pros And Cons Of 529 Plans Should You Open One For College Student Loan Hero

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog

Oklahoma College Savings Plan Oklahoma 529 College Savings Plan Ratings Tax Benefits Fees And Performance

529 Plans Which States Reward College Savers Adviser Investments

States That Offer 529 Plan Tax Deductions Bankrate

Tax Benefits Nest Advisor 529 College Savings Plan

529 Plan State Tax Fee Comparison Calculator 529 Plans Nuveen

Oklahoma 529 Plans Learn The Basics Get 30 Free For College Savings

529 Plans Which States Reward College Savers Adviser Investments

Tax Benefits Nest Advisor 529 College Savings Plan

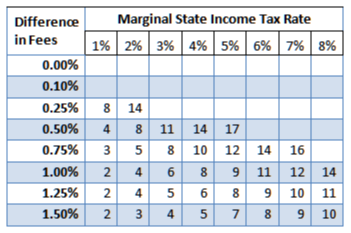

When Is A State Tax Break Better Than Lower Fees On A 529 Plan

Can I Use A 529 Plan For K 12 Expenses Edchoice

529 Plans Which States Reward College Savers Adviser Investments

How Do I Choose A 529 Morningstar 529 College Savings Plan College Savings Plans Saving For College

States That Offer 529 Plan Tax Deductions Bankrate

How Much Is Your State S 529 Plan Tax Deduction Really Worth Savingforcollege Com

Tax Deduction Rules For 529 Plans What Families Need To Know College Finance